The 5-3 Method and how it can help you save money effectively

The 5-3 Method is designed to be a straightforward, sustainable way to manage your finances. By incorporating these simple rules into your financial routine, you develop both discipline and a long-term approach to saving. Here’s how The 5-3 Method to save money works and why it’s effective:

Here’s how The 5-3 Method works and why it’s effective:

The 5% Rule (Spending)

The 5% rule encourages you to be mindful about the amount of money you spend on each individual purchase. The idea is to limit your big purchases (or any non-essential item) to 5% of your monthly income. This helps you prevent overspending and impulse buys that could derail your financial goals.

- How to Apply: If you make $3,000 a month, spending on a single item (e.g., a new phone, a designer jacket, etc.) should be no more than $150. If you’re considering something over that price, ask yourself: Is this worth 5% of my income? Do I really need it?

- Why It Works: This rule encourages you to be more thoughtful about what you purchase. You begin to evaluate the true value of items, asking yourself if it’s a want or a need. It also keeps you from spending excessively on things that don’t provide lasting value.

- Example: Imagine you’re at the store looking at a new laptop. It costs $800, but your monthly income is $3,000. Based on the 5% rule, this laptop would take up more than 25% of your income, which should be a red flag. Instead of making that impulsive purchase, you might decide to shop around for a more affordable model that better fits your budget.

The 3% Rule (Saving)

The 3% savings rule is about creating a habit of saving by setting aside at least 3% of your monthly income each month. While 3% may not sound like a lot, it’s a manageable amount that you can build on over time, and it’s all about consistency.

- How to Apply: If your monthly income is $3,000, you’d aim to save $90 each month. This doesn’t have to be invested or saved in one specific place — it could be into your savings account, an emergency fund, or even retirement savings.

- Why It Works: Saving a small, consistent amount each month makes the habit sustainable. It doesn’t feel like a burden, and by the time you look back a few months later, you’ll have saved a significant amount. Additionally, it builds financial security by ensuring you’re always putting money aside for future needs.

- Example: If you set aside $90 each month into a savings account, after a year, you’ll have saved $1,080. While this might not seem like a huge sum in the short term, it adds up quickly and can be used for emergencies, vacations, or bigger investments later.

Why This Method Works for Long-Term Financial Success:

- It’s Sustainable: The 5-3 Method encourages slow, consistent changes to your spending and saving habits. Since the rules are flexible (you don’t have to follow them strictly), they’re easy to incorporate into your everyday life without overwhelming you.

- Prevents Lifestyle Creep: By sticking to the 5% spending rule, you’re less likely to fall into the trap of lifestyle inflation, where you spend more just because you earn more. It helps you keep your priorities in check and avoid unnecessary luxuries.

- Easy to Monitor: Tracking both your savings and spending becomes easier with the 5-3 method. By focusing on a set percentage, you can quickly assess if you’re staying within your limits, and you don’t need to get bogged down by complicated budgeting systems.

- Flexible and Adaptable: The 5-3 method can work no matter your income level. Whether you’re making $2,000 or $10,000 a month, you can adapt these percentages to suit your personal financial situation. If you feel comfortable, you can even increase your savings percentage over time.

What I think about 5:4 Method:

The 5-3 Method isn’t just about budgeting — it’s about developing a mindset of being conscious about your money. It’s about making small, intentional decisions now that add up to big financial benefits down the road. If you can consistently follow the 5% spending rule and save 3% each month, you’ll start to see a positive shift in your finances.

As with any financial plan, consistency is key. Even small savings can help build financial stability, and over time, you’ll have more money saved up for emergencies, future goals, or investments. By avoiding unnecessary purchases and committing to saving, you’ll be better positioned to manage your money and work toward financial freedom.

*Disclaimer: The financial information provided here is for educational purposes only and should not be considered as financial advice. It is not intended to recommend any specific financial products, services, or strategies. Please consult with a qualified financial advisor or professional before making any financial decisions.

I also share some of my favorite collections from travel essentials to beauty favorites on Shopmy, please check it below:

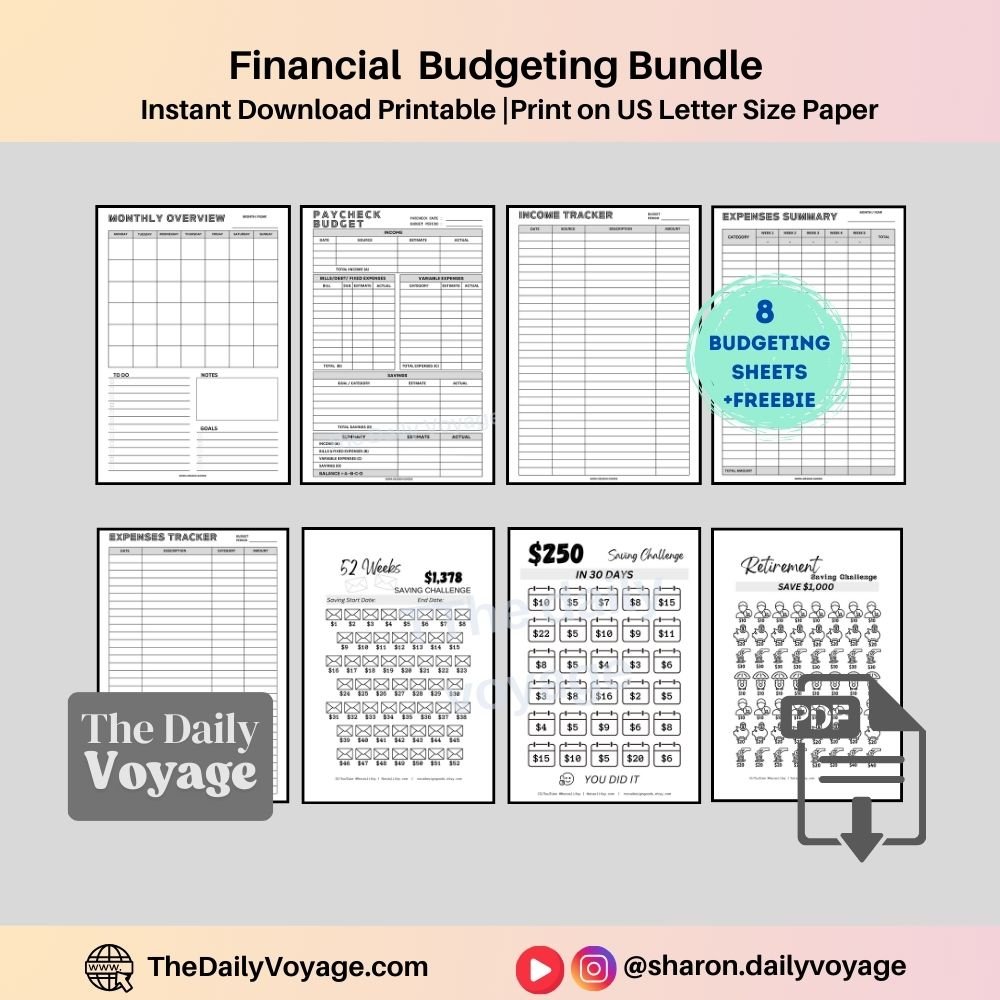

🌿 Are you interested in my monthly budgeting tools? It’s Free to download!! Sign up the newsletter🌿

Looking for simple ways to feel better, eat well, and live more mindfully? Sign up for our newsletter and get easy wellness tips, cozy recipes, and gentle reminders to take care of yourself—no pressure, just good vibes.

Shop My Design And Budget Planning Tool